Table of Content

Homes for Heroes, Inc. is a licensed real estate company in the state of Minnesota. We are committed to serving American heroes and maximizing what they can save on a home. On average, our heroes save over $3,000 when they buy, sell or refinance a home with our local specialists.

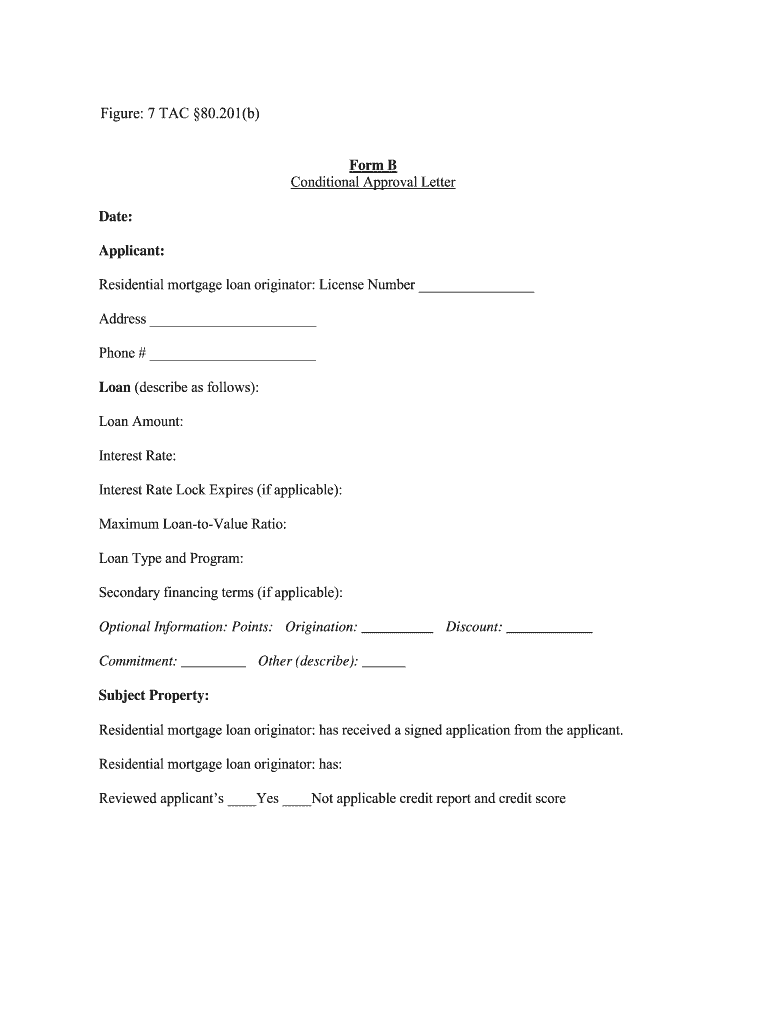

It’s crucial and should be done before starting your search for a new home. Prequalification involves speaking with a licensed loan officer who will give you an estimate of what you can afford based on your income and debt. However, many first-time buyers find themselves confused about the approval process and its stages. When you’re ready to submit an offer on a home, know the difference between prequalified and preapproved.

Want to discuss your home loan needs? We’re here to help.

They do that by reviewing documents you submit, looking at your credit report, and following up with questions. How many days before closing do you receive mortgage approval? Clear to close timelines vary by lender and evenunderwriting team. There are also unique conditions that could extend the clear to close timeline. Unusual aspects on a loan application or spikes in mortgage team workloads can cause the process to take longer. Technically speaking, this is the final step in the mortgage approval process, though there is one more step before the deal is done — and that’s closing.

Your loan officer will want to ensure that you can repay the borrowed funds on time, and your income is a huge indicator of that. In most cases, you can use financial documents like invoices, tax returns, bank statements, etc., for your loan application. Initial loan approval is one of the first steps of a loan application. Lenders will use this process to determine whether they want to move forward with an applicant.

Conditionally approved vs. other types of mortgage approval

When you apply for a payday loan, small personal loan, or credit card, you can expect a response in about two to five business days. While something like a mortgage can take up to two weeks or so. Your Processor will submit the file back underwriting for the final loan approval once all conditions have been procured. The Underwriter typically reviews conditions within 24 to 48 hours. Within a few days of closing lenders may update your credit report to reflect the most recent credit balances and view any new credit inquiries. Hopefully, you’ve followed the do’s and don’ts of a home loan and won’t have any issues.

Remember that a hard credit inquiry will bring down your credit score a few points, so it is best to space them out. Our Prequalified Approval is the fastest way to get approved with Rocket Mortgage. You won’t be required to provide any documents, but you should come prepared with information about your income and assets.

Apply for a mortgage today!

Preapproval and prequalification are both ways of understanding how much you’ll be able to get approved for. There are some slight differences between these two processes, though some lenders use these terms interchangeably. It can be hard to shop for a home without knowing how much you can afford. Mortgage preapproval lets you shop smarter and make stronger offers.

To speak with our local mortgage specialist in your area simply sign up on our site. We will alert them to contact you and they will answer all of your questions. The Guarantee also does not apply to loans applied for through third parties (e.g., Lending Tree) or originated through loanDepot’s Wholesale division.

You can find a personal loan at a bank, credit union, or private lender. Less common than the other requirements listed above, lenders may ask to talk to references. References can sometimes be helpful when it comes to character traits. However, this is becoming less of a common thing for many financial products. The Initial Closing Disclosure document will be emailed to you after the initial underwriting approval.

They will explain how each loan works and what it costs, including interest rates, features, fees and additional charges. It’s also your opportunity to clear up any confusion you have about the process before you get started. Credit requirements for homeownership vary between lenders and loan types. Typically, FHA loans require a credit score of at least 580; conventional and VA loans require a score of at least 620; and USDA loans require a credit score of 640 or higher. But lenders often set their own requirements which may be higher or lower. This process will help determine your debt-to-income ratio which helps lenders see whether you could afford the new loan’s monthly payments.

For a home priced at $350k, for instance, you could be looking at a payment difference of $12 to $25 per month for every .125% increase in the interest rate. But note that these amounts do add up over the life of the loan. All mortgage lenders have a turn time, which is the time from submission for underwriter review to the final lender's decision. Internal policy on how many loan operations the staff carries at one time is often the biggest factor. Things as simple as the weather can throw off lender turn times quickly. For instance, if you live in a place where major blizzards are common in the winter—think Rochester, New York—you should know that a big storm may delay the process.

When it comes to mortgage lending, no news isn't necessarily good news. Particularly in today's economic climate, many lenders are struggling to meet closing deadlines, but don't readily offer up that information. When they finally do, it's often late in the process, which can put borrowers in real jeopardy. The final stage is settlement, where the lender certifies that your documents are in order and they can advance the loan. If you are purchasing a property, your solicitor/conveyancer will be informed about it.

The Processor will update your Floify document portal to request additional documents from you should any conditions require your attention. Please provide any outstanding paperwork as soon as possible since we will be unable to move forward without them. The best way to start to discuss your eligibility for a home loan is to speak with a mortgage broker, as there are many benefits to using a broker. Our award-winning mortgage brokers will find you the right home loan for your needs. Any credit issues, such as late payments, collections, and/or judgments, require a written explanation. The information on the application, such as bank deposits and payment histories, are verified.

Please note that applications, legal disclosures, documents or other material related to Guaranteed Rate products or services promoted on this page are offered in English only. The Spanish translation of this page is for convenience of our clients; however, not all pages are translated. If there is a discrepancy between the content of the translated page and the content of the same page in English, the English version will prevail. The type of transaction — purchase or refinance — determines who can provide you with accurate final numbers. Once all conditions have been met, the Loan Coordinator will send the file back to the Underwriter for a final review and approval. Here are the six major milestones you'll reach during loan processing and what’s happening at each stage of the process.

The Loan Officer and Mortgage Consultant will work to submit a complete file to the Underwriter. However, an Underwriter may still have questions or ask for more documents for a final approval. The underwriter is the key decision-maker during the mortgage approval process.

No comments:

Post a Comment