Table Of Content

- Calculate your monthly mortgage payment

- U.S. Mortgage Rates Jump Above 7% for the First Time This Year

- Learn more about 30-year mortgages

- ‘We expect Powell to make a hawkish pivot’—Fed meeting to headline busy week for global markets

- What is a lender credit?

- How to compare mortgage rates?

- Insights from Economists: Detailed Predictions for Mortgage Rates in April 2024

Both the 30-year and 15-year mortgage rates have ticked up this week. The national average 30-year mortgage rate is 7.17%, which is seven basis points higher than this time last week. Mortgage interest is the cost you pay your lender each year to borrow their money, expressed as a percentage rate.

Calculate your monthly mortgage payment

For borrowers who want a shorter mortgage, the average rate on a 15-year fixed mortgage is 6.94%, up 0.09 percentage point from the previous week. The current average mortgage rate on a 30-year fixed mortgage is 7.73%, compared to 7.61% a week earlier. If your details closely match those used to calculate today’s rates, possibly. Compare your credit score, debt-to-income ratio and loan amount to the ones we used by selecting the View Legal Disclosures link under where rates are displayed.

Friends split a mortgage, share a home to beat high housing costs - Star Tribune

Friends split a mortgage, share a home to beat high housing costs.

Posted: Sat, 27 Apr 2024 12:01:25 GMT [source]

U.S. Mortgage Rates Jump Above 7% for the First Time This Year

A mortgage rate is the percentage a lender charges on the money you owe for the purchase of real estate. The lender multiplies the mortgage rate by the amount you still owe to determine how much interest you'll pay each month. When interest rates are higher, you have to make bigger monthly payments compared to the payments for the same loan at a lower rate. If you can't afford the bigger monthly payments, you might have to borrow less. Bankrate has helped people make smarter financial decisions for 40+ years.

Learn more about 30-year mortgages

Here are the factors that influence the average rates on home loans. Katherine Watt is a CNET Money writer focusing on mortgages, home equity and banking. Based in New York, Katherine graduated summa cum laude from Colgate University with a bachelor's degree in English literature. We offer a wide range of loan options beyond the scope of this calculator, which is designed to provide results for the most popular loan scenarios. If you have flexible options, try lowering your purchase price, changing your down payment amount or entering a different ZIP code.

Federal Housing Administration (FHA) loans have lower interest rates and only require a 3.5% down payment. One of the best ways to get the lowest possible mortgage rate is to comparison shop by comparing rates from multiple lenders. Lenders look at your debt-to-income (DTI) ratio, which compares your gross monthly income to your debts, to determine how much you can afford.

For those who want to maximize their dollars to ensure the highest return on investment, finding the right mortgage is essential. Some borrowers might think the best way to save money is to pay off their mortgage faster—by opting into a shorter loan term with higher monthly payments—but that’s not always the case. While ARM loans typically offer an initially lower rate than a 30-year mortgage, after the fixed period ends, interest rates and monthly payments may go up. Because the adjustment period is unpredictable, ARM loans are seen as a high-risk loan option while 30-year mortgages are viewed as low-risk. Getting a mortgage should always depend on your financial situation and long-term goals. The most important thing is to make a budget and try to stay within your means.

How to compare mortgage rates?

Current HELOC rates are relatively low compared to other loan options, including credit cards and personal loans. A HELOC is a line of credit that lets you borrow against the equity in your home. It works similarly to a credit card in that you borrow what you need rather than getting the full amount you're borrowing in a lump sum. It also lets you tap into the money you have in your home without replacing your entire mortgage, like you'd do with a cash-out refinance. The Fed has signaled in recent months that it may keep the cost of borrowing higher for longer amid stubborn inflation.

Insights from Economists: Detailed Predictions for Mortgage Rates in April 2024

On the other hand, a homeowner who is refinancing may opt for a loan with a shorter repayment period, like 15 years. This is another common mortgage term that allows the borrower to save money by paying less total interest. However, monthly payments are higher on 15-year mortgages than 30-year ones, so it can be more of a stretch for the household budget, especially for first-time homebuyers.

Is a 30-year fixed-rate mortgage right for you?

"We got great, attentive service, and importantly, a very competitive rate that we were happy with." "was easy to upload documentation, i got a great rate, and am extremely happy with the service." “Hopefully, we’re near the end of this part of the rate cycle, and interest rates will decline at some point in the next year or two,” says Cohn. Recent economic data suggest that a Fed rate cut might not happen now until next year.

Weigh the pros and cons of a 15- versus 30-year loan and take time to understand ARM rates and how they differ from traditional fixed mortgage rates before signing on the dotted line. The best mortgage rate for you will depend on your financial situation. Loan term (years) - This is the length of the mortgage you're considering.

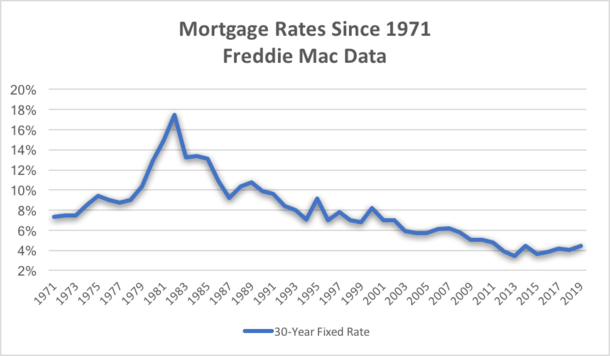

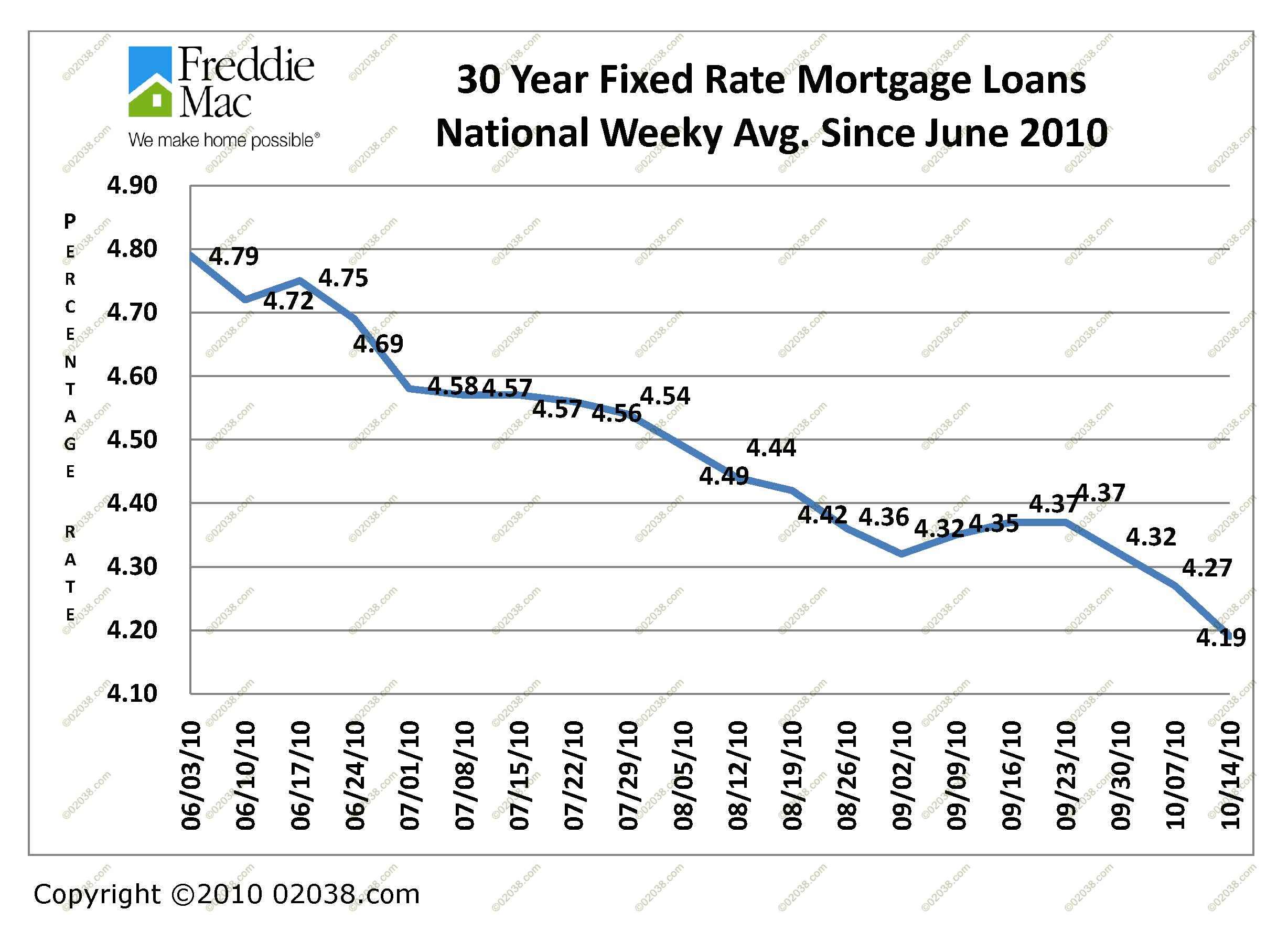

The Fed’s benchmark interest rate is currently the highest it’s been in 22 years. Rates on 30-year mortgages — the most common kind among U.S. homeowners — surpassed the 7 percent mark on Thursday, a troublesome sign for an already tight housing market. The average 30-year fixed mortgage rate is over 7% for the second straight week, according to Freddie Mac.

No comments:

Post a Comment