Table of Content

The definition of preapproval can vary depending on which lender you speak with. They may even offer a couple of different types of preapproval with varying expiration dates. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. Apply online for expert recommendations with real interest rates and payments.

When it comes to mortgage lending, no news isn't necessarily good news. Particularly in today's economic climate, many lenders are struggling to meet closing deadlines, but don't readily offer up that information. When they finally do, it's often late in the process, which can put borrowers in real jeopardy. The final stage is settlement, where the lender certifies that your documents are in order and they can advance the loan. If you are purchasing a property, your solicitor/conveyancer will be informed about it.

How jumbo loans can help home buyers and your builder business

Let’s look at what it means to get preapproved and how to get started. The time can vary due to the complexity of a file and the completeness of paperwork. The Processor will submit the file to underwriting for the initial underwriting approval.

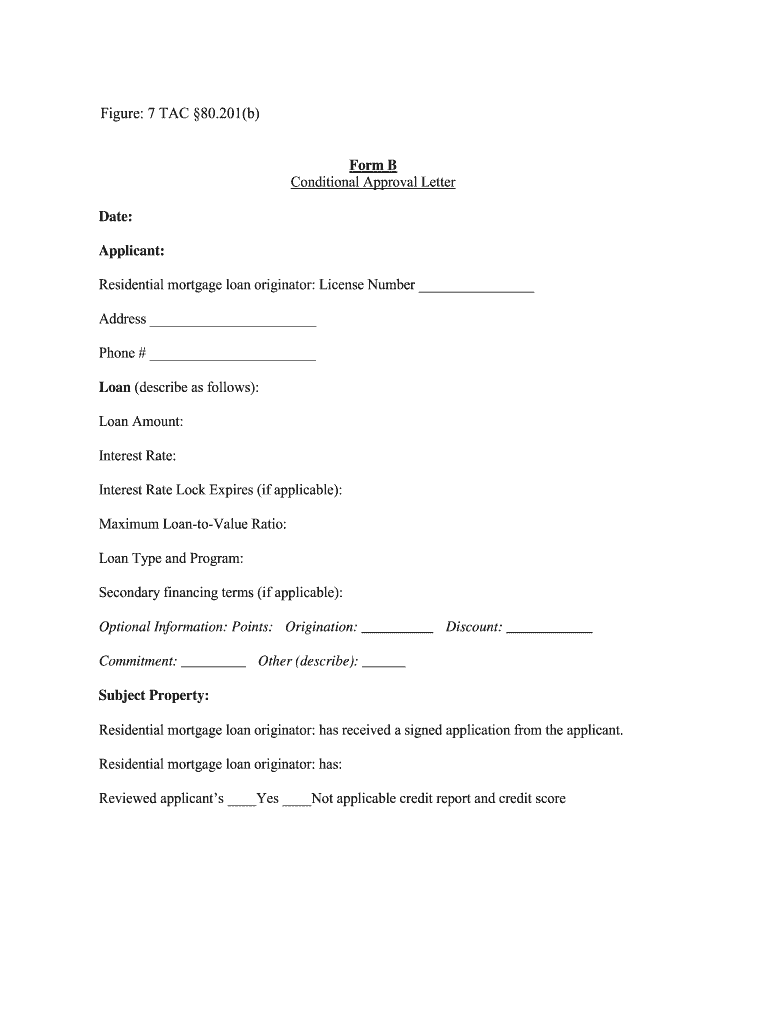

If your loan application presents an acceptable level of risk for the underwriting team, then they will grant you conditional loan approval. If your loan application presents an acceptable level of risk for the underwriter, they will grant you conditional loan approval. We hope you’ve found this guide to the mortgage approval process helpful, and wish you all the best in your home-buying quest. If the issues discovered are minor in nature, and the borrower can resolve them in a timely manner, then the mortgage loan can move forward and eventually result in approval. However, if the underwriter discovers a serious issue that is outside the eligibility parameters for the loan, it might be rejected outright.

What Not To Do Before Applying For A Mortgage

You still have to attend closing to sign a bunch of paperwork, and then the loan has to be funded. The underwriting process itself can be smooth or “bumpy,” depending on your financial situation. Once your underwriter has thoroughly reviewed your application, they then decide on what category to put you in.

To submit an offer, and have a good chance of winning the bid in a competitive market, you will likely need a pre-approval letter from your lender. Do your due diligence and get pre-approved for a home loan first so you do not miss out on that house. Getting pre-approved for a home loan is the initial process of the mortgage industry that qualifies a potential home buyer for a mortgage.

Pre-Settlement Inspection Checklist

Then, you can work backward using today’s mortgage interest rates to determine your maximum home buying power. Whether you’re thinking about buying or you’re ready to close, our Buying a House tool can help you navigate and make informed decisions at each stage of the homebuying journey. You have this 3-day window to thoroughly review your loan information and ask any final questions of your lender. A Loan Estimate isn’t an indication that your loan application has been approved or denied. A Loan Estimate is a three-page form providing important information about the mortgage loan you’re considering. There are a few common conditions attached to a conditional home loan approval.

Your lender will likely need another 1-2 weeks to finalize your home loan and set yourclosing date. The short answer to whether pre-qualified is the same as pre-approved is, not really, and here’s why. And yes, they both provide a preliminary dollar estimate a borrower may qualify to receive toward a purchase. If you have questions, loanDepot’s licensed loan officers are always here to help in yourhomebuying process; call us today.

How Long Does A Loan Application Take?

This means the approval amount, loan program and interest rate might change as the lender gets more information. Because a prequalification is an initial review of your finances, you usually don’t need to supply documentation during this stage. Mortgage preapproval is the process of determining how much money you can borrow to buy a home. The next step in the mortgage loan process is processing and credit approval. The file is assigned to the Processor once it has been throughloan setup. The Processor works with the Underwriter, the Closer, and the title companyto close your loan.

It is the amount of your monthly debt payments, compared to your gross monthly income. To know your DTI, use a mortgage calculator to estimate your monthly mortgage payment, and then add to it your other monthly debt payments. Underwriting is where the “rubber meets the road,” when it comes to loan approval. It is the underwriter’s job to closely examine all of the loan documentation prepared by the loan processor, to make sure it complies with lending requirements and guidelines. Credit card limit increases add to your purchase power with a credit card by increasing your available credit.

There is no guaranteed timeline for how long it'll take to close on your home after receiving conditional approval. The conditional approval process usually takes anywhere from 1 – 2 weeks, and the closing day comes shortly after that. After the loan has been formally approved, the lender will send you a loan offer document, including a contract for you to sign and accept. If you would like to consult your solicitor or conveyancer for legal advice before signing, you can do so.

The company name, Guaranteed Rate, should not suggest to a consumer that Guaranteed Rate provides an interest rate guaranteed prior to an interest lock. Closing processes vary slightly depending on the type of transaction. Order a home appraisal to determine the value of the property.

Apply online with Rocket Mortgage® today and take that first step toward owning your new home. The LTV is the reverse of your down payment in a purchase situation, or the inverse of your equity amount in a refinance. If the conditions aren’t met, the client might not be able to close on the loan. People often confuse conditional approval and the approval you get to shop for a home. Once you hear those words, there will be only a few more hoops to jump through. Cut your down payment check, sign on the dotted line, and get ready to move into your new home.

No comments:

Post a Comment